Why Revenue Operations Matters to the CEO

Why Revenue Operations Matters to the CEO

CEOs are maximizing the return on their growth assets and managing sales, marketing, and customer support resources as a single high-performing revenue team

Revenue operations is a board-level issue that requires top-down leadership and change management for a simple reason – it directly impacts their primary fiduciary responsibility to protect and grow firm value. This is because organic growth, and the commercial assets that create it, have become essential to value creation.

Revenue operations is a board-level issue that requires top-down leadership and change management for a simple reason – it directly impacts their primary fiduciary responsibility to protect and grow firm value. This is because organic growth, and the commercial assets that create it, have become essential to value creation.

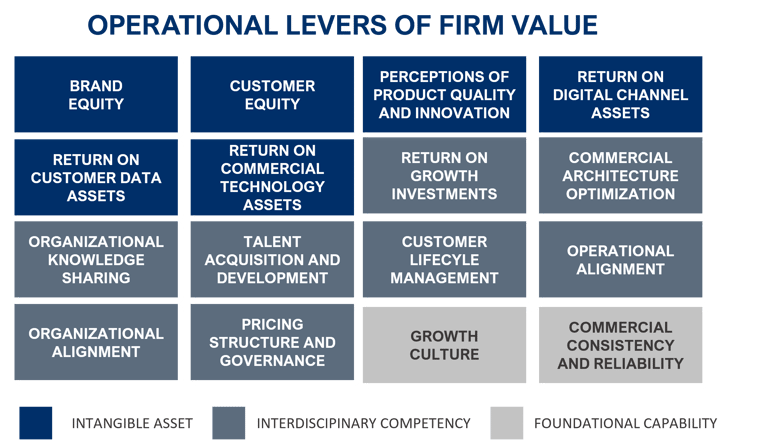

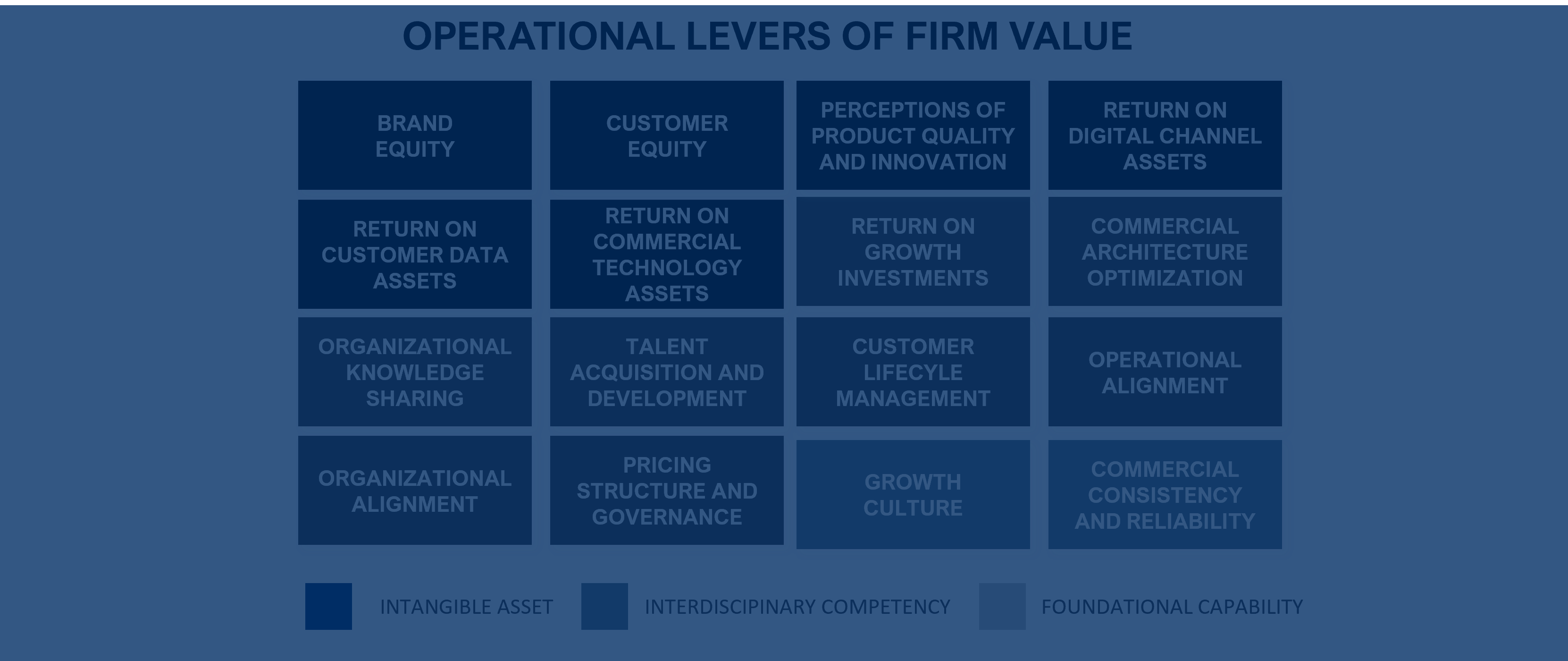

In the 21st century, the majority of firm value is built on intangible assets – customer relationship equity, brand preference, data and insights, process know-how, and digital channel infrastructure. A number of commercial and academic research studies have documented that, when properly measured and accounted for, these intangible assets represent in excess of 80% of the value of a business.7, 55,56, 57 The ability of revenue teams to deploy these assets to grow future revenues and profits by building customer preference, conversion, loyalty, and usage while commanding price premiums are the primary drivers of firm value. As evidence of this, over two-thirds (68.1%) of Private Equity firms are pushing their portfolio companies to grow at faster than 10% a year to justify the price premiums they have paid.58

The Financial Link Between Revenue Growth and Firm Value

The growing relationship between revenue growth and firm value can be seen in the high valuations awarded to businesses that can deliver predictable, scalable, and profitable growth or hyper growth (in the case of cloud businesses). For example, the marketplace values firms with hyper growth (over 40%) and predictable revenues (Annual Recurring Revenues) disproportionality. That is why a hyper growth business like HubSpot commands PE ratios in the hundreds while not yet showing a profit. It also explains why a pure play SaaS business like Salesforce.com – where the majority of revenues are recurring and revenue growth rates are in double digits – will have a valuation in excess of 60 times its earnings while the average business in the S&P 500 growing at 4% has historically generated 18 times its earnings.59,52

Any business can unlock more growth and value by improving the return on their commercial assets. Revenue generating commercial assets – customer data, digital technology, digital channel infrastructure, customer relationship equity – make up most of the growth investment mix in B2B organizations according to an analysis by the Marketing Accountability Standards Board.1 They also make up a significant portion of firm value. Most CEOs have a large opportunity to generate more revenue and profits from these commercial assets.

The growing importance of Revenue Operations to creating firm value is not lost on the owners and boards of high growth business. For example, several private equity firms like Rockbridge Growth Equity, Morgan Stanley Private Equity, Tengram Partners, and Vista Equity Partners have created a growth culture, operating model, and infrastructure to support accelerated growth at scale across their portfolio by creating centers of excellence in demand generation, call centers and digital marketing channels. For example, Rockbridge is the PE arm of the Quicken Loans group. They have been able to leverage their highly sophisticated marketing capability and focus on customer experiences that Quicken Loans used to become the #1 mortgage provider and launch of Rocket Mortgage into a major brand across the other firms in our portfolio.

Average purchase price multiples are at historic highs (in excess of 13 times EBITDA) and most PE believe financial engineering will not be enough to justify such high prices and deliver their LPs the returns they expect.60

Jim Howland, an Operating Partner at Morgan Stanley Private Equity, sees the role of the private equity investor evolving from pure financial engineering towards enabling faster revenue growth in the last few years. “What you do with an asset is as or more important as getting that asset at the right price,” reports Howland. “The reality is that if you want to attract good deals and make a return in today’s PE world, you need to have a plan for how you will add value over the entire ownership period and build it into the price you pay for the asset. And a big part of that value plan is built around marketing and growth capabilities.”

Investment banker Ben Howe, CEO of AGC Partners, reinforces reports that Private Equity owners are increasingly creating value using a “buy, grow, and build” model of governance and enablement. “The top tech buyout funds including Vista, Thoma Bravo, and Insight are relentless in their programmatic efforts to build organically and apply operational best practices to enhance organic growth via ongoing technology, go-to-market initiatives and product improvements across the organization” reports Howe. “Stories like Vista taking Marketo private for $1.8 billion with ample leverage, growing it at 66% and then selling it to Adobe for $4.8 billion generating a multi-billion dollar return in just 2 years tends to get LP’s attention.”

Growth leaders are the unwitting caretakers of what may be their company’s most valuable asset: its customer data. For example, customer data assets in the airline industry – which include revenue management, frequent flyer, and customer engagement databases – account at times for 100% or more of an airline’s profitability and value. Yet they do not show up on any balance sheet or management report because these databases are regarded as “intangibles” – just like R&D, “process know how”, and brand equity – by accountants and don’t get measured, reported, and managed as closely as physical assets like inventory or real estate – even though they are far larger and more strategic. As evidence of this, both United Airlines and American Airlines recently secured multi-billion dollar loans by collateralizing their MileagePlus and AAdvantage customer loyalty programs, respectively. The third-party appraisals of their data suggest that it is worth two to three times more than the market value of the companies themselves. United’s customer data was valued at $20 billion while its market cap at the time was about $9 billion. Similarly, American’s data was valued at a minimum of $19.5 billion and up to a jaw-dropping $31.5 billion, whereas its own market cap was hovering at less than $8 billion. Unfortunately, most CEOs, CXOs, CIOs and their CFO counterparts don’t put a financial value on their customer data because nobody is responsible for the assets and accounting regulations and insurers say they don’t have to, according to Doug Laney, author of the book Infonomics.62

Customer engagement data like this has become a key strategic asset in every business because it creates the foundation of future growth, profitability, and competitive advantage. This data grows firm value by optimizing pricing, the probability of conversion, account priorities and the allocation of growth resources in every business in a 21st Century Commercial Model. So it has become very important for business leaders to recognize, measure, and manage them as a real asset – including insisting on a financially viable return on asset (ROA).

This ambiguity and lack of stewardship applies to all of the large commercial assets in the business – including the sales and marketing technology portfolio, brand equity, and the growing investments in owned digital channel infrastructure that displaced paid media in the marketing mix and became essential to competitive differentiation in B2B selling.

A second and related problem is that executives cannot agree on the causal chain of events that leads to revenue growth and the future cash flows that underlie firm value. This leads executives to have no financially valid way to make growth bets and tradeoffs and optimally allocate resources across growth alternatives. It also makes it difficult to build a business case and management consensus on the capabilities that can create the greatest value to the firm. For example, most business leaders pay lip service to the notion of being data driven, digital, agile, and customer-focused as a basis for competitive advantage. They understand these things are strategically important, but in most cases they lack a financially valid basis for evaluating and managing these strategic value drivers and a tangible set of corporate initiatives to exploit them in the marketplace. But academic research proves that these are the primary causal factors that determine the financial value of the enterprise.

A big reason corporate leadership struggles with the long-term growth formula is they can rarely agree on the big questions underlying their growth strategy such as the math of growth, the value and importance of growth assets, and a valid economic formula to guide growth investment. “With all the focus on advanced analytics and data-driven marketing, not much progress has been made on understanding the fundamental math of growth in a business,” reports Professor Dominique Hanssens of the UCLA Anderson School of Management and author of the book The Long Term Impact of Marketing. “In my experience, executive teams that make the big growth bets often lack consensus and alignment on fundamentals like the true cost of customer acquisition, the right balance of customer acquisition relative to customer retention, and the financial contribution of the brand to the business.”

Academic and commercial research have made it overwhelmingly clear that growth is a “team sport” and that there is a causal relationship between organizational competence in analytics, marketing, information sharing, agility, and cross-functional collaboration with enterprise value. This research shows that a 10% increase in organizational competence will drive on average a 5.5% increase in stock price.7 An analysis of 380 CMOs by Forbes found that organizations investing in data-driven measurement processes, competencies and systems were achieving significantly higher levels of marketing effectiveness and business outcomes – achieving 5% better returns on marketing investments and more than 7% higher levels of growth performance.7 The analysis revealed that these high-performing marketers – who were exceeding growth goals by over 25% – were significantly more data-driven in their approach to measuring, optimizing, and reallocating their offline and online sales and marketing investments.

Investments in customer insights and agility do create firm value. How fast and effectively an organization analyzes, leverages and shares information and customer data can increase tactical marketing returns but also generate long term enterprise value.63 Academic research has proven there is a significant and casual relationship between how fast your organization shares data and customer insights across revenue teams and share price.6 A comprehensive analysis of 114 academic research studies by the Marketing Science Institute (MSI) has demonstrated that the ability of an organization to generate, disseminate and respond to market intelligence – called Organizational Knowledge Sharing – has a quantifiable positive effect on firm value and financial performance in terms of profits, sales, and market share.6

This is important for managers to recognize and prioritize because modern selling systems produce customer data that allows revenue teams to identify trigger events that signal buying intent, flag inquiries from important influencers within accounts, and make decisions about next best actions based on past customer behavior. However, the window of time an organization has to act on that data is small – gated by customer time, attention, and expectations for response. This makes speeding data and decisions about an opportunity from the source (e.g. a website, an algorithm in marketing) to a customer facing employee who can act on it (e.g. a relationship manager or customer service rep) a critical value driver.

Similarly, customer relationships, go to market effectiveness, organizational information sharing, customer experience, and the quality of products, people and innovations have all been empirically proven to drive increases in firm value by academics. 6

In particular, the push to focus the organization on the customer and make building customer lifetime value the common purpose of the revenue team has a financial basis. Customer equity is a significant driver of share price. According to academic research the value elasticity of customer equity is 0.72.6 This means a 10% increase in the value of customer assets will drive a 7.2% increase in stock price because higher levels of customer satisfaction, trust and online service innovations enhance long term margins, sales growth, and enterprise value.6,7 This is because the lifetime value is being redefined as an economic model in a digitally driven economy. This is evidenced by the ability of businesses like AirBnb ($92B in firm value with no profits) and the GHX Global Healthcare Exchange to convert digitally enabled consumer and business networks into valuable assets.59

For example, Rockbridge pushes its portfolio companies to deploy advanced analytics and direct marketing competencies pioneered by another Rockbridge company, Quicken Loans, to accelerate revenues, profits, and firm value. One Rockbridge portfolio business that provides online postgraduate education, North Central University, was able to borrow demand generation practices developed by Quicken Loans to grow their enrolled student population from 5,000 to 9,000 over their 6 years of ownership. This led to rapid growth in revenues (from $31M to $114M) and EBITDA (from $6M to $29M) and a highly successful exit.

You can learn more about how boards, CEOs, and growth leaders (CXOs) are maximizing the return on their growth assets and managing sales, marketing, and customer support resources as a single high performing revenue team by reading the book Revenue Operations, a New Way to Align Sales and Marketing, Monetize Data, and Ignite Growth (Wiley). This exhaustively researched bbook provides and actionable blueprint with specific guidance to help growth leaders stairstep their organization to a more unified approach to managing commercial revenue teams, assets, and processes. It will also isolate the clear financial benefits of making those incremental changes from a revenue, margin and cost and value perspective.

.png)