What is Revenue Operations and How Does it Create Value?

A Management System For Aligning Sales, Marketing, And Customer Success and Realizing More Revenues, Opportunities and Firm Value

The formula for revenue growth has changed dramatically in the last 25 years as buying has become more digital, data-driven, and complex. The commercial model has evolved to the point where traditional structures for managing the people, processes, technologies, and assets that support revenue growth are inadequate.

The emergence of complex technology enabled selling systems – amplified by the wholesale business model transformation and changing customer buying behavior in B2B businesses – have changed the basis for generating revenue growth in the 21st Century. The forces behind this change are fundamental.

>> The customer experience has emerged as the primary basis of competition as digitally enabled customers armed with better information and access are putting a premium on speed, agility, personalized content, and channel integration. This has created pressure on organizations to establish a single cross functional commercial process across the enterprise and coordinate across management systems and platforms to ensure a unified customer experience as the performance goal.

>> Cloud business models have increased the importance of growing customer equity and lifetime value as a driver of firm value and forced sales, marketing, customer experience and support services teams to find ways to work together collectively as one revenue team.

>> The assets that support modern selling – customer data, technology, content, and digital channel infrastructure – have grown to represent the lion’s share of growth investment and firm value. These critical commercial assets significantly underperform in most organization because they are not properly measured, funded, or managed and they fail to adequately support the entire revenue team and enable scalable technologies such as 1:1 personalization, real-time coaching, response management, and account based marketing at scale.

>> Information velocity and visibility increasingly determine selling effectiveness. The speed of engagement and the velocity at which information needs to be commercialized and shared across the organization has accelerated to the point where revenue teams and the executives that direct them need real time. Visibility into customer engagement, seller effectiveness, account and pipeline health are the four top drivers of the performance of distributed, diverse, digital, and dynamic revenue teams.

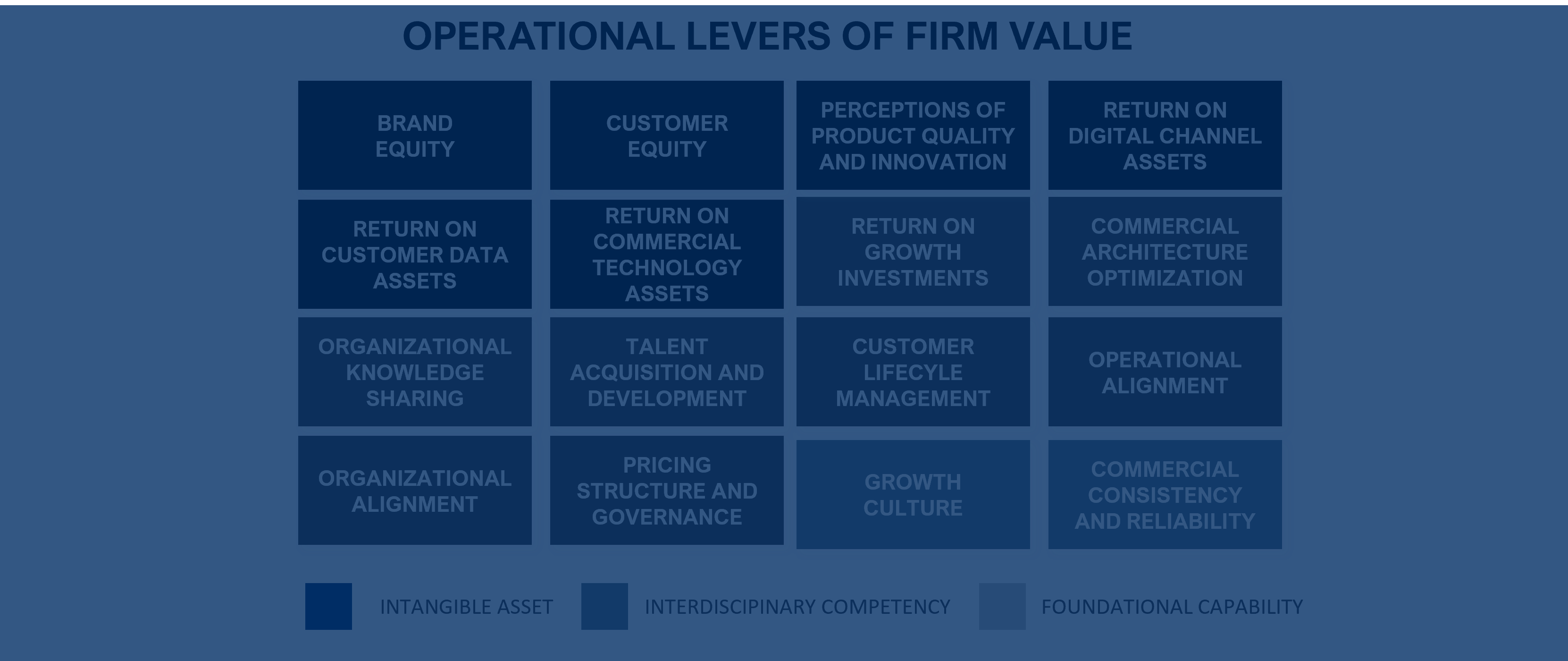

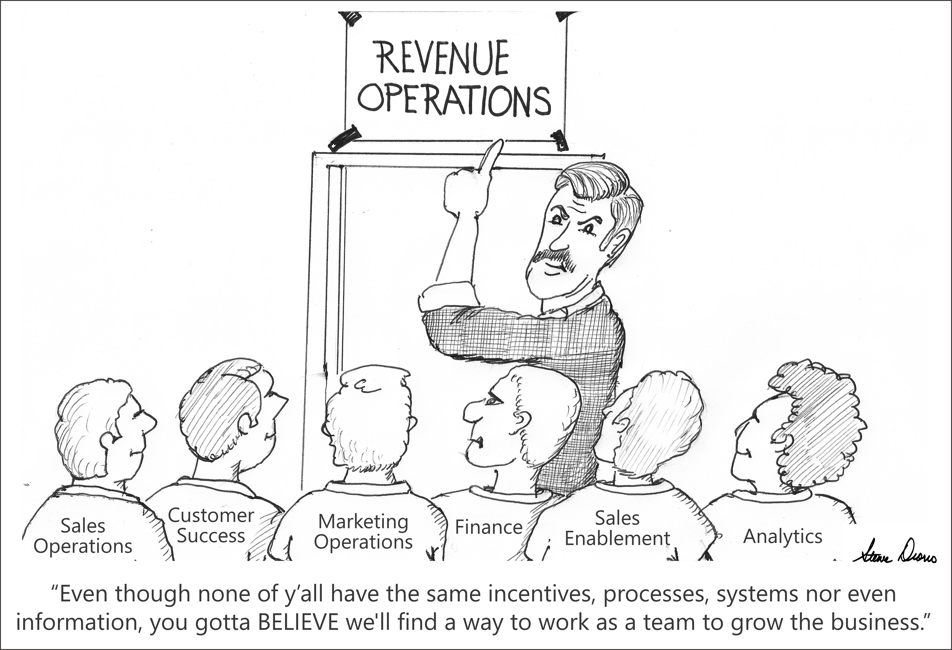

>> Teamwork across functions has become fundamental to growth. There are 16 value levers that directly impact revenues, profits, and cash flow in a business, according to the Revenue Operations Benchmark Model. These range from information agility to customer equity, digital channel experience, to sales and marketing effectiveness. But no single organization or leader controls all 18 growth levers. Developing operating models, incentives, and platforms that help get marketing, sales, and service silos working as one revenue team with a single common purpose has become a primary growth imperative.

Collectively, these forces have made commercial models based on the functional management of marketing, sales, customer success, and fulfilment resources and the notion of linear customer journey partitioned by function obsolete. The business and financial consequences of commercial obsolescence are very real. The disconnected management of the technology, data and digital infrastructure assets that support revenue growth leads to lower than acceptable financial returns and higher selling costs. The uncoordinated management of the commercial process leads to revenue and margin leaking through “air gaps” and handoffs in the customer journey. Put another way, a poorly managed commercial model is like an expensive racing car that can neither drive fast or far enough because it is only firing on one or two cylinders and getting terrible gas mileage for lack of alignment and a tune up.

The underlying problem is simple. Managers are trying to use organizational systems developed in the 20th century to manage a far more advanced and digital commercial model in the 21st Century.

Management models evolve. The corporation, conglomerate, and business unit structures pioneered by Rockefeller (standard oil), Reginald Jones (GE), and Alfred Sloan (GM) respectively were all structural innovations that served their purpose in their time. But modern selling requires levels of speed, accountability, visibility, and teamwork that are unmanageable in a traditional functional stovepipe organization model.

A new management system is needed. One that does a better job of generating greater returns from commercial selling teams, processes, systems, and operations.

This management system is most commonly described as a Revenue Operations model. There is general agreement that Revenue Operations is important, but little clarity on how to define and describe it because it is a nascent discipline. The executives and managers trying to squeeze more growth from their revenue teams in the face of these secular trends are in pain and looking for a cure. In a sense they are like patients who describe their symptoms and pain to doctors and are looking for a diagnosis. In the absence of established management theory and precedent, there are plenty of analysts, experts, and point solutions ready to present a quick cure. This creates mostly noise and confusion and little sound executive guidance.

To better define the Revenue Operations model in a modern commercial model, our team has engaged hundreds of business leaders, as well as the leading academics and experts in the field.

Based on the research in this analysis, Revenue Operations is best described as a management system that better aligns sales, marketing and customer success teams - and the assets, systems, operations, and processes that support them - to grow revenues, profits, and firm value. . Our best selling book – Revenue Operations: A New Way to Align Sales and Marketing, Monetize Data, and Ignite Growth – rigorously breaks that definition down into specific operational components that span the people, process, and technology of revenue growth. There are six specific elements to a revenue operations model that growth leaders need to deploy to align their revenue teams, commercial assets, systems, and processes to continue growing revenues and customer lifetime value.

- Commercial Leadership: This involves top down leadership to empower and endorse the transformation of the commercial model to unify sales, marketing, and service into one revenue team and become more accountable, data-driven, and customer focused.

- Commercial Operations: This involves reconfiguring the operations that support growth to provide end-to-end coherent management of all human sellers, customer facing assets, enablement investments, and the customer journey.

- Commercial Architecture: This includes redesigning and optimizing elements of the commercial architecture to maximize return on selling assets in terms of speed, visibility, productivity, and engagement at a lower cost to sell.

- Commercial Insights: This involves turning customer engagement and seller activity data into commercial insights that create value and inform decisions, actions, and conversations at the “moments that matter” in the human selling process.

- Commercial Effectiveness: This includes building capabilities that enable human selling and maximize the contribution of selling assets and investments to revenue and profit growth outcomes.

- Commercial Asset Management: The strategic management of the data, technology, content, and IP assets to maximize utilization, impact, and return on investment.

SIX ELEMENTS OF A REVENUE OPERATIONS MODEL

The business practices underlying these six elements of the Revenue Operations model are detailed in greater depth in the 72-point Revenue Operations Benchmark Assessment developed by Slate Point Partners.

Regardless of vocabulary or definition, the need to better manage growth assets and get sales, marketing and customer support organizations working as one revenue team is an existential issue for every B2B organization. One that requires board level attention and top down CEO leadership, and a willingness to change entrenched beliefs and management models supporting growth. Revenue operations is a board level issue for a simple reason – it directly impacts their primary fiduciary responsibility to protect and grow firm value. This is because organic growth, and the commercial assets that create it, have become essential to value creation in every business.

>> CEOs leading enterprises can generate more significantly more revenue and profits from their revenue generating commercial assets – customer data, digital technology, digital channel infrastructure, customer relationship equity – because these assets are poorly managed, measured, and monetized in a 20th century commercial model.

>> Private Equity investors have put in place operating models and infrastructure to support accelerated growth at scale across their portfolio as a means justify such high prices and deliver their LPs the returns they expect as average purchase price multiples reach historic highs (in excess of 13 times EBITDA).

>> Boards are pushing their CEOs to pursue business model transformation to a cloud, subscription, or recurring revenue model. In response, they are aligning their sales, marketing and CX Teams around the customer to generate the growth and net recurring revenues needed to make the successful transition without significant disruptions to cash flow and profit growth.

>> Cloud businesses will need hyper growth in excess of 50% year on year with low levels of revenue leakage and customer churn if they expect to meet the valuation expectations of the investors who provided their growth capital in a frothy market.

Learn about the Revenue Operations Benchmark Assessment

You can learn more about how boards, CEOs, growth leaders and investors are maximizing the return on their growth assets and managing sales, marketing, and customer support resources as a single high performing revenue team by reading the Revenue Operations: A New Way to Align Sales and Marketing, Monetize Data, and Ignite Growth book. The goal of this book is to provide boards, CEOs, and growth leaders (CXOs) a blueprint for maximizing the return on their growth assets and managing sales, marketing, and customer support resources as a single high performing revenue team. The blueprint will provide specific guidance to growth leaders on how to stairstep their organization to a more unified approach to managing commercial revenue teams, assets, and processes. It will also isolate the clear financial benefits of making those incremental changes from a revenue, margin and cost and value perspective. Specifically, the book will teach readers:

- What Revenue Operations Is

- How Adopting a Revenue Operations Model Creates Value

- Why Revenue Operations Matters to the CEO

- How Revenue Operations Can Grow Revenues, Profits, and Value in Your Business

- The Trends Driving the Emergence of Revenue Operations as An Existential Business Issue

- The Six Elements of a Revenue Operations Model

- Steps Your Organization Can Take to Better Align Your Commercial Teams, Assets, Systems, And Processes.

- A 90 Day Plan to Stair Step Your Organization Towards Commercial Transformation

The Appendix of the book details a comprehensive 72-point Revenue Operations maturity model. This is a simple and intuitive benchmark assessment help your leadership quickly assess the state of your commercial transformation. It will also identify the most financially viable way to “stairstep” your organization towards greater alignment of sales, marketing and CX teams, systems, and processes. Our expert faculty is available to coach and conduct these assessments if desired.

A good way to start using Revenue Operations to realize the untapped growth potential in your business is to take a simple yet powerful self-assessment tool we created based on this proprietary model. The Revenue Operations Benchmark Self-Assessment (ROBTM) is a holistic benchmark of the growth capabilities and assets in your business that identifies the opportunity to unlock more revenue growth and provides a foundation for consistent and scalable growth. The ROSA is a simple but powerful tool to help managers quickly assess, size, prioritize and unlock the latent revenue growth potential in your business. It is a streamlined high impact-low effort, self-service assessment tool designed to give organizations (managers/leaders) a quick yet insightful snapshot of their revenue operations and the most profitable pathways to growth through teamwork and greater asset utilization. monetization potential. It uses a proprietary financial model to comprehensively compare and evaluate your current commercial practices and capabilities with peer best in class across the 16 operational value levers proven to drive future revenues, cash flow, and firm value. By investing less than half an hour answering a scientifically designed set of questions, you will get a benchmark analysis of your performance and potential across the 46 essential growth drivers. In addition you will get a quantifiable assessment of the latent growth potential in the business as well as the operational growth levers and actions that can most profitably unlock that growth potential.

To get access to the Revenue Operations Benchmark Self-Assessment tool, click the calendar link and arrange an appointment to learn about the tool and see if you are qualified for a free assessment.