CEOs and CFOs Need to Stop Flying Blind When it Comes to Managing Growth

A Better Way For Boards, CEOS And Managers To Evaluate And Measure The Growth Performance Of Their Businesses In A Modern Economy

The ability to reliably and accurately assess and unlock a company’s capacity to generate sustainable revenue growth and hit financial targets is critical to business owners and managers. Why? Because organic revenue growth – the increase in a company’s sales over time – is the primary basis for creating business value. What investors are buying - and managers are trying to generate – are future cash flows.

This makes the ability to understand and maximize a company’s core underlying ability to generate these future cash flows a critical business discipline.

The core problem facing managers is that it is inherently difficult to predict and forecast future revenue growth. This is becoming increasingly more difficult as the nature of the digital economy and the commercial models businesses use for generating revenue growth evolve.

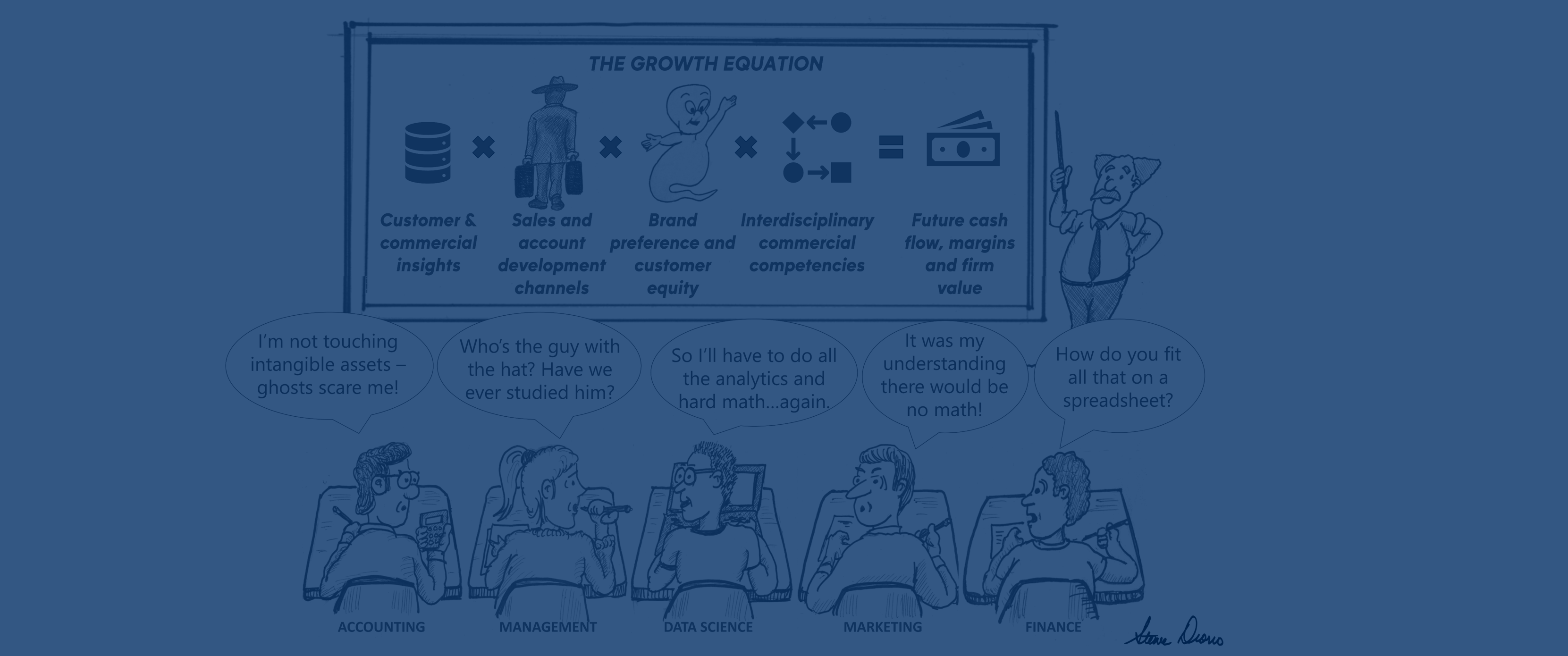

The root of the problem is that the traditional approaches used by both investors and executive leaders to assess the future growth potential of a business are fundamentally flawed. To start, they are seriously impaired by conventional financial, managerial, and operational accounting rules. Common management practice make the problem much worse than it needs to be. Despite the importance of organic revenue growth to value, the “science and math of growth” are neither very well understood nor agreed upon by managers and their CFOs. Compounding the problem is the fact that the commercial assets that generate growth are hard to measure, manage, and report since they are largely “intangible.” The situation is only getting worse because a confluence of many secular trends are making it increasingly difficult for managers to effectively evaluate, fund, and manage growth. In particular:

The growing role of intangible assets in firm value: The majority of the value in firms is intangible commercial assets. These include things like market-based assets, knowledge assets, computerized information innovative property, and economic competencies. When properly measured and accounted for, these intangible assets can represent up to 70% or more of the value of a business, according to an analysis of over 100 academic and commercial studies by Slate Point Partners. For example, 72% of Microsoft’s market valuation is attributed to intangible assets such as computerized information (e.g. internal and external software development, or AI algorithms), innovative property (e.g. R&D, New Product Development), and economic competencies (e.g. market insights, and process “know how”) according to research by Haskel and Westlake in the book Capitalism Without Capital: The Rise of the Invisible Economy. The ability of revenue teams to deploy these assets to grow future revenues and profits by building customer preference, conversion, loyalty, and usage while commanding price premiums are the primary drivers of firm value. As evidence of this, over two-thirds (68.1%) of Private Equity firms are pushing their portfolio companies to grow at faster than 10% a year to justify the price premiums they have paid.

The changing nature of the commercial model: The commercial model has become a much more capital intensive, digital, data-driven team sport. This means the primary drivers of firm value and future growth are intangible, interdisciplinary, and “invisible” in financial reporting and accounting. Growth has become more capital intensive because two thirds of growth budgets are investments in commercial information, commercial technology, channel infrastructure and brands aimed at creating assets that accelerate revenues and grow firm value in the long term. Growth is more digital because 83% of buyers journey happens in digital channels through a mix of 20 or more digital channel that require and create large amounts of customer information according to an analysis by Gartner.

The interdisciplinary nature of growth. In addition, growing a business has become more interdisciplinary. Business-to-business commercial growth processes entail higher degrees of orchestration across over a dozen channels, twenty commercial systems, and a growing number of data repositories to generate, realize and retain revenues, according to the Revenue Operating Systems report. This means functional siloes of product, marketing, sales and service have become a drag on company performance. For example, the disjointed and siloed way most organizations manage their growth resources, assets and processes lead to revenue leakage, customer experience failures, and uncoordinated account development. Disjointed finance, marketing, sales, technology and customer service organizations are not very good at sharing customer engagement information along the revenue cycle. To adapt, 90% of organizations are combining marketing, sales, and customer success functions around the customer. They are also connecting the dots across their systems, database, content, and IP assets along the revenue cycle to get a better picture of pipeline health, customer value and the long-term revenue picture.

A greater emphasis on recurring and expansion revenues in valuation. The majority of B2B firms in an information-based economy rely more heavily on recurring revenue and customer expansion via cross selling platforms as the basis of their value (due to subscription, platform, cross sell and “as a service models). This raised the bar for the quality of revenue growth (e.g. the Rule of 40) required to IPO or exit at a high multiple. This puts even greater pressure on PE funds to provide more active support to their portfolio companies. The higher bar for company performance - combined with rising interest and longer holding periods – has private investors spending 75% of their effort finding ways to improve the operations and systems for driving organic revenue growth within their portfolio companies, according to a survey of 170 PE leaders by Accenture.

These dynamics have fundamentally reshaped the allocation of growth resources, operating budgets and capital investment. Owned digital sales and marketing channels and the systems, data, content and operations that support them now command two thirds of operating budgets, displacing paid media and the overhead that supports field sales. And capital investment in the digital selling infrastructure, customer databases, and enabling technologies that support these digital channels and “4D” selling teams has created some of the biggest financial assets on the balance sheet. In some cases, the customer data within a business can be more valuable than the business itself.

These dynamics have fundamentally reshaped the allocation of growth resources, operating budgets and capital investment. Owned digital sales and marketing channels and the systems, data, content and operations that support them now command two thirds of operating budgets, displacing paid media and the overhead that supports field sales. And capital investment in the digital selling infrastructure, customer databases, and enabling technologies that support these digital channels and “4D” selling teams has created some of the biggest financial assets on the balance sheet. In some cases, the customer data within a business can be more valuable than the business itself.

All of this means that the traditional tools investors and managers use to assess the ability of a business to generate revenues and hit its targets in the future – revenue forecasts, financial analysis, Quality of Revenue audits - fail to provide a complete or reliable picture. Conventional approaches to forecasting, recognizing, and realizing future revenues are fragmented and flawed. The traditional financial and managerial accounting, management reporting and measurement systems used by investment analysts, CFOs and leadership team fail to provide visibility into the majority of the operational drivers of growth and value in a business. For example, traditional financially based Quality of Earnings analysis can miss up to ninety percent of the future earnings picture because they only look at historically based financial statements. In a sense, owners, boards, CEO’s and managers are flying blind when it comes to managing growth. This inability to reliably assess the future revenue generating ability of a business is becoming a fiduciary issue to board members because it adds risk and costs while depressing return on invested capital.

Why are the operational drivers of future revenue, cash flow, and firm value growth invisible?

There are several good reasons for this. They include:

- There are no external (e.g. financial reporting standards) and internal (e.g. management accounting standards) that provide visibility into the value, health and performance of intangible commercial assets. Commercial assets are defined as market-based assets, knowledge assets, computerized information, innovative property, and economic competencies.

- Few managers have the experience or acumen to effectively manage and measure a commercial model that combines marketing, sales and customer success functions and relies more heavily upon commercial technology, information and economic competencies to grow (e.g. putting the right people in the right seats).

- There is little agreement – in terms of understanding, reporting, or consensus among owners, boards and managers about the contribution of commercial actions, assets and investment to firm value, financial performance or future cash flow.

- There is very low awareness, understanding or application of the growing body of methods and models developed in both academic and commercial research that provide the ability to more effectively value, protect, and grow the value of a firms assets.

As a consequence, financial statements do little to reveal the true and latent potential of a business to generate future revenues, margins and positive cash flow. FASB standards don’t require accountants to reveal the inner workings of a company or delineate between growth expenses, investments and assets. Any forward-looking revenue and margin forecasts are often uncertain estimates. Managerial accounting clumps selling costs into big buckets (SG&A). And operational KPI tend to optimize a functions output (cost of acquisition, cost per lead) but not the business outcomes of the whole “cross functional” system (customer lifetime value). This means critical assets such as digital selling infrastructure, customer databases and brand are booked as expenses under managerial accounting principles. So instead of being managed and measured as an asset, they are viewed as a cost – and one that can easily be cut without consequences to the long term cash flow of the business. "The Original Sin of Accounting for Marketing is that all marketing investments are immediately expensed," says Professor Neil Bendle, co-author of Marketing Metrics: The Definitive Guide to Measuring Marketing Performance. “The growing difference between market and accounting values of the business are due to intangible assets and flaws in Financial Accounting Rules,” according to Professor Roger Sinclair in his research on the Moribund Effect.

The Revenue Operations Benchmark Analysis – A Better Way for Managers to Evaluate, Manage and Realize the Growth Potential of a Business

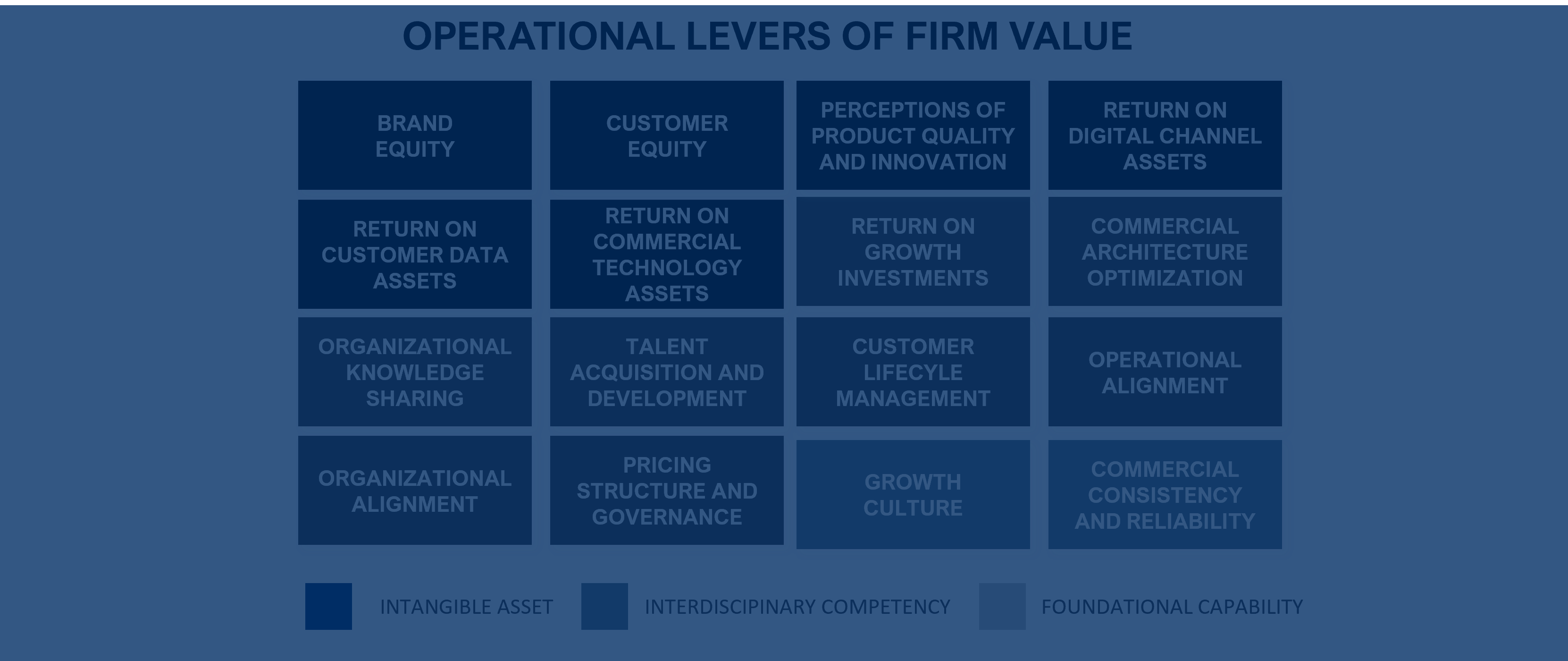

To help the managers and boards develop a more financially valid and actionable means for valuing, measuring, protecting and growing the value of their businesses, Slate Point Partners conducted a meta-analysis of over 100 academic and commercial research studies. The research focused on studies that attempted to quantify the causal impact of market based intangible assets and interdisciplinary commercial competencies on future revenue growth, cash flow and firm value. The effort identified sixteen operational value levers that describe 100% of the known drivers of future revenues, cash flow and firm value.

At a high level, the research revealed that the much of future revenue generating potential is directly attributable to commercial assets. Commercial assets include “intangible assets” such as brand equity, and customer equity, and perceptions of quality and innovation which can constitute a third or more of firm value. They also include “hard” but difficult to value assets such as the digital infrastructure including sales and marketing channels, the systems that enables their operations, and manages the customer data that they generate. In all the research identified six operational value levers that involved the monetization and optimization of intangible assets. The notion of measuring, managing and monetizing commercial assets is important because they are an important lever to unlock growth. Every business can unlock more growth and value by improving the return on their revenue generating commercial assets – customer data, digital technology, digital channel infrastructure, customer relationship equity. Investment in building and curating these assets makes up most of the growth investment mix in B2B organizations and a significant portion of firm value.

Emerging research on Revenue Operations adds to this body of knowledge by describing and quantifying an additional eight of the sixteen operational value levers. This research revealed that eight interdisciplinary competencies that are causal of future revenue growth is interdisciplinary competencies notably in strategy and planning, human capital, sales process, commercial technology portfolio management and pricing governance and discipline.

The meta-analysis also affirmed the critical role of commonly accepted foundational capabilities in the areas of management competencies (ability to execute, product development) and process driven variables (like strategy, planning, and forecasting), as well as cultural factors that impact revenue growth.

The output of this comprehensive analysis of academic, commercial and capital markets research, the Quality Of Revenue Operations Report is a benchmarking framework encompasses the sixteen operational growth levers with the greatest demonstrated effect on future organic revenue.

As an output of this analysis, the research the Revenue Operations Benchmark model that encompasses the sixteen operational value levers and the greatest demonstrated effect on future organic revenue. The framework embeds 46 discrete drivers with the greatest demonstrated effect on future organic revenue. These operational growth levers are outlined and defined below. Thee academic, commercial and capital markets research that provides evidence of the causal relationship between these growth drivers and future revenue growth, cash flow and firm value - are described more depth in the Quality of Revenue Operations Report.

16 REVENUE OPERATIONS VALUE LEVERS

While perhaps not perfect, these levers do a far better job than current attribution and accounting models at both describing how growth is created, and quantifying the financial impact of growth investments and actions on the business. Using a value chain analysis it models the causal relationship between growth actions, assets, and investments and future revenue growth. This “math of growth” gives managers a financially valid basis for both quantifying the value of specific commercial assets as well as assessing the financial impact of growth actions, investments, and decisions on firm value and financial performance. The model provides managers to more comprehensive and financially valid way to prove the financial contribution of commercial assets, systems, capabilities and teamwork. It provides the math to more accurately quantify the untapped growth potential in the business and the science to isolate the levers required to unlock that growth. The model also provides a basis for evaluating, measuring and benchmarking the growth potential and performance of a business. It also arms managers with best practices to improve and manage revenue generation performance.

This helps leadership teams to build a common understanding and consensus about the ways they can work together to affect changes that generate the most scalable and consistent growth. It helps to establish a financially valid basis overcoming the “opportunity overload” and inertia that comes with evaluating the hundreds of possible growth actions and decisions to zero in on the top 5-10 opportunities, investments, actions and plans and to start the process of continuous improvement

REVENUE OPERATIONS BENCHMARK GROWTH INVESTMENT ANALYSIS

Conducting a Revenue Operations benchmark analysis is a better way for boards, CEOs and their management teams to assess a company’s ability to generate sustainable revenue growth and hit financial targets than traditional financial analysis of the quality of earnings. A Quality of Revenue Operations benchmark is a forward-looking analysis that objectively grades a company based on its capabilities in forty six operational and functional drivers of future revenue growth potential areas that are key to sustainable revenue generation and hitting revenue growth targets. They include:

- The alignment of the commercial teams, systems, processes and operations that support the full revenue cycle across people, product, process, and technology;

- The robustness of the core functional capabilities in marketing, product and revenue cycle management;

- The strength of growth leadership and the growth strategy, planning process, and culture they have instilled;

- The maturity of core operational capabilities in pricing, analytics, performance measurement, and customer experience management.

By focusing on the core drivers proven to be causal of future growth can help managers to get better visibility into their ability to hit revenue targets and quantify the untapped growth potential of their business assets. The Quality of Revenue Operations analysis can also help owners identify ways to create new value by identifying the root causes of poor or inconsistent revenue growth results, and objectively measuring performance on a normalized and “apples-to-apples” basis.

A REVENUE OPERATIONS BENCHMARK ANALYSISA Revenue Operations Benchmark analysis is a comprehensive, empirical, and forward-looking evaluation of the ability of a business to generate consistent and scalable growth. The Quality of Revenue Operations analysis is unique because it evaluates a company’s potential to grow across the operational value levers proven to impact future revenues, cash flow, and firm value. The analysis benchmarks an organizations commercial capabilities, assets, and competencies across forty six growth drivers that span the functional and operational drivers of growth. The holistic analysis is unique because it evaluates both your core commercial capabilities and the interdisciplinary competencies that determine your ability to execute growth strategies and realize more growth. These include the critical ability to align operations and teams along the revenue cycle, share and monetize information, and generate returns on growth investments and assets. The resulting scores provide boards, leaders, and operators a fact-based assessment of the probability of hitting future revenue targets and the root cause issues holding back growth. In addition to scores, the analysis quantifies the latent growth potential in the business, and recommends specific growth drivers and action steps that have the greatest potential to unlock that revenue, continuously improve performance, and realize the full growth potential from commercial assets. |

The Revenue Operations bechmark analysis can also help CEOs and their management teams evaluate and understand and make investment decisions related to the key assets and capabilities that impact a company’s ability to generate future revenues that are missed by financial analysis. This approach can significantly reduce the risks, price and costs of their investments. It also provides CEOs and executives a prioritized roadmap for unlocking more growth from existing commercial assets by better allocating resources, aligning sales and marketing, optimizing pricing, and eliminating revenue leakage along the revenue cycle.

A good way to start using this model to evaluate the untapped growth potential in your business is to take a simple yet powerful self-assessment tool we created based on this proprietary model. The Revenue Operations Benchmark Self-Assessment (ROBTM) is a holistic benchmark of the growth capabilities and assets in your business that identifies the opportunity to unlock more revenue growth and provides a foundation for consistent and scalable growth. The ROSA is a simple but powerful tool to help managers quickly assess, size, prioritize and unlock the latent revenue growth potential in your business. It is a streamlined high impact-low effort, self-service assessment tool designed to give organizations (managers/leaders) a quick yet insightful snapshot of their revenue operations and the most profitable pathways to growth through teamwork and greater asset utilization. monetization potential. It uses a proprietary financial model to comprehensively compare and evaluate your current commercial practices and capabilities with peer best in class across the 16 operational value levers proven to drive future revenues, cash flow, and firm value. By investing less than half an hour answering a scientifically designed set of questions, you will get a benchmark analysis of your performance and potential across the 46 essential growth drivers. In addition you will get a quantifiable assessment of the latent growth potential in the business as well as the operational growth levers and actions that can most profitably unlock that growth potential.

To get access to the Revenue Operations Benchmark Self-Assessment tool, click the calendar link and arrange an appointment to learn about the tool and see if you are qualified for a free assessment.