Why Investors and Managers Need A More Reliable Assessment of a Company’s Ability To Generate Sustainable Revenue Growth Than Traditional Financial Analysis Of The Quality Of Earnings

Why the Quality of Revenue Generation is Important to Investors, CEOs, and Managers

The ability to reliably and accurately assess a company’s ability to generate sustainable revenue growth and hit financial targets is critical to investors, owners and managers. Why? Because organic revenue growth – the increase in a company’s sales over time – is the primary basis for creating business value. The thing investors are buying – and managers try to generate – are future cash flows. This makes the ability to understand and maximize a company’s core underlying ability to generate these future cash flows a very important business discipline. The more sustainable and scalable that growth is, the more valuable your business becomes. In fact the ability to grow revenues organically has created more firm value than all efforts to reduce costs, expand earnings multiples, and improve free cash flow combined. The ability to sustainably generate and grow future revenues is now essential to generating a return on capital in a marketplace where rising interest rates, inflation, and competition for deals take the teeth out of financial leverage, engineering, and multiple arbitrage.

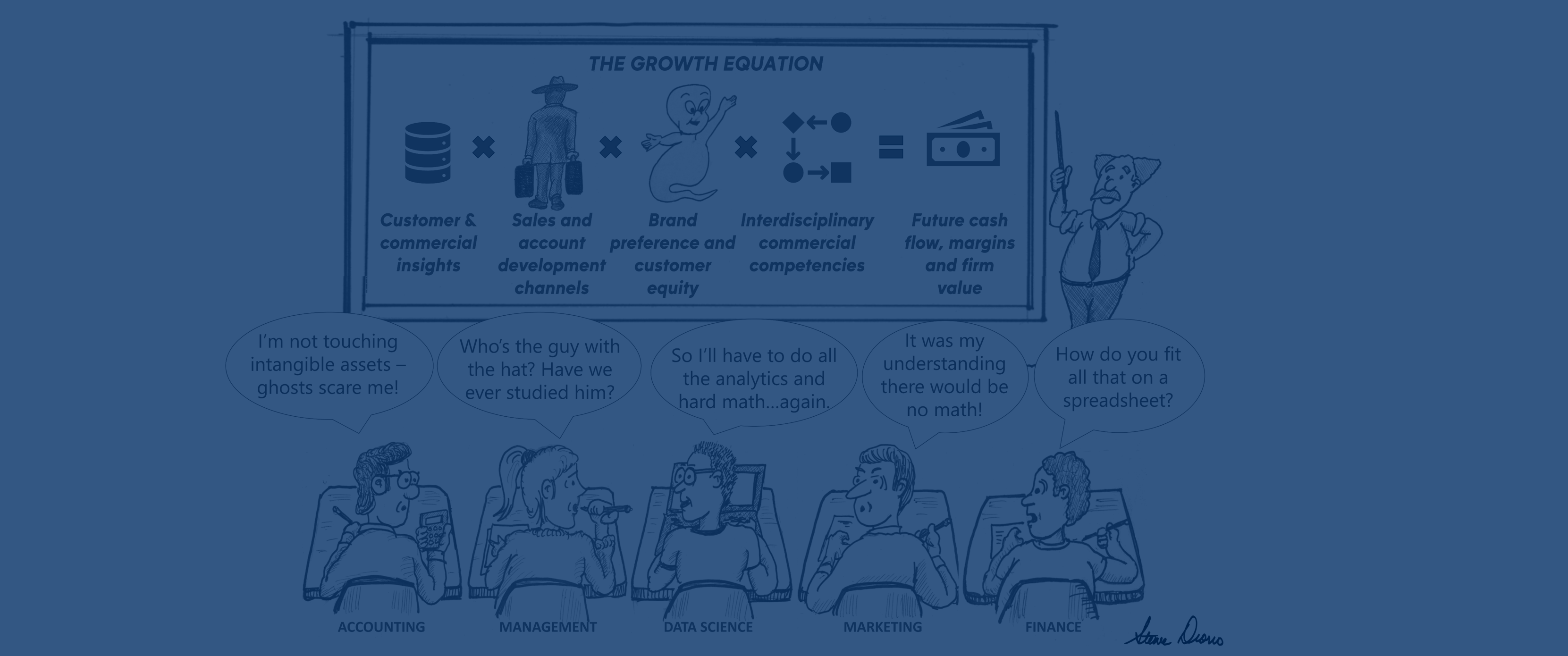

The Problem With Traditional Approaches to Assessing and Forecasting Future Revenues. It is inherently difficult to predict and forecast future revenue growth. That is why equity investing is both risky and lucrative. But the traditional approaches to forecasting and assessing the future growth potential of a business by both investors and executive leaders make the problem much worse. Despite the importance of organic revenue growth to value, the “science and math of growth” are not very well understood by investors, owners and managers. The commercial assets that generate growth are hard to measure, manage, and report because they are largely “intangible.” Finally, the disjointed way most organizations manage their growth resources, assets and processes mean finance, marketing, sales and customer service are bad at sharing the information along the revenue cycle that can provide a better picture of pipeline health, customer value and the long term revenue picture.

This means that traditional tools investors and managers use to assess the ability of a business to generate revenues and hit its targets in the future – revenue forecasts, Qualify of earnings analysis and customer interviews fail to provide a reliable picture. Conventional approaches to forecasting, recognizing, and realizing future revenues are fragmented and flawed. Traditional financially based Quality of Earnings analysis can miss up to three quarters of the future earnings picture because they only look at historically based financial statements.

As a consequence, this inability to reliably assess the future revenue generating ability of a business adds risk and costs while depressing return on invested capital.

A Revenue Operations Benchmark Assessment Is A Better Way To Assess A Company’s Ability To Generate Future Growth. A Revenue generation assessment is a better way for investors, CEOs and their management teams to assess a company’s ability to generate sustainable revenue growth and hit financial targets than traditional financial analysis of the quality of earnings. A Quality of Revenue (QofR) analysis is a forward-looking analysis that objectively grades a company based on its capabilities in nine core operational and functional drivers of future revenue growth potential areas that are key to sustainable revenue generation and hitting revenue growth targets. The operational and functional drivers have all been proven to be causal of future revenue growth. They include:

- The alignment of the commercial teams, systems, processes and operations that support the revenue cycle [the people, process, technology of growth]

- The robustness of the core functional capabilities in marketing, product and revenue cycle management

- The strength of growth leadership and the growth strategy, planning process, and culture they have instilled

- The maturity of core operational capabilities in pricing, analytics, performance measurement, and customer experience management

This focus on the core drivers of future growth helps investors and executives to get better visibility into their ability to hit revenue targets and quantify the untapped growth potential of their business asset. A Revenue Operations Benchmark (ROBTM) analysis also helps create new value by identifying the root causes of poor or inconsistent revenue growth results, and objectively measuring that performance on a normalized and “apples-to-apples” basis.

A Revenue Operations Benchmark assessment helps investors, CEOs and their management teams evaluate and understand the key assets and capabilities that impact a company’s ability to generate future revenues when they buy or manage a business that are missed by financial analysis. This approach can significantly reduce the risks, price and costs of their investments. It also provides CEOs and executives a prioritized roadmap for unlocking more growth from existing commercial assets by better allocating resources, aligning sales and marketing, optimizing pricing, and eliminating revenue leakage along the revenue cycle.

A Revenue Operations Benchmark (RoBTM) assessment is an objective, empirical and forward-looking analysis of the ability of a business to generate consistent, predictable and scalable growth in revenues, margins and future cash flow which are the foundations of firm value. The RoBTM analysis scores and benchmarks a company in the 9 core functional and operational drivers of growth, including: strategy, culture, processes, revenue operations, customer analytics, marketing, product, pricing and revenue management. The resulting scores provide investors, leadership, and operators a fact-based assessment of the probability of hitting future revenue targets plus identify the root cause issues holding them back. In addition to scores, the RoBTM analysis provides specific action steps that have the greatest potential to improve performance and realize the full growth potential in their business assets. |

You can learn more by reading the Revenue Operations Benchmark Report, or asking for a demonstration at www.slatepointpartners.com