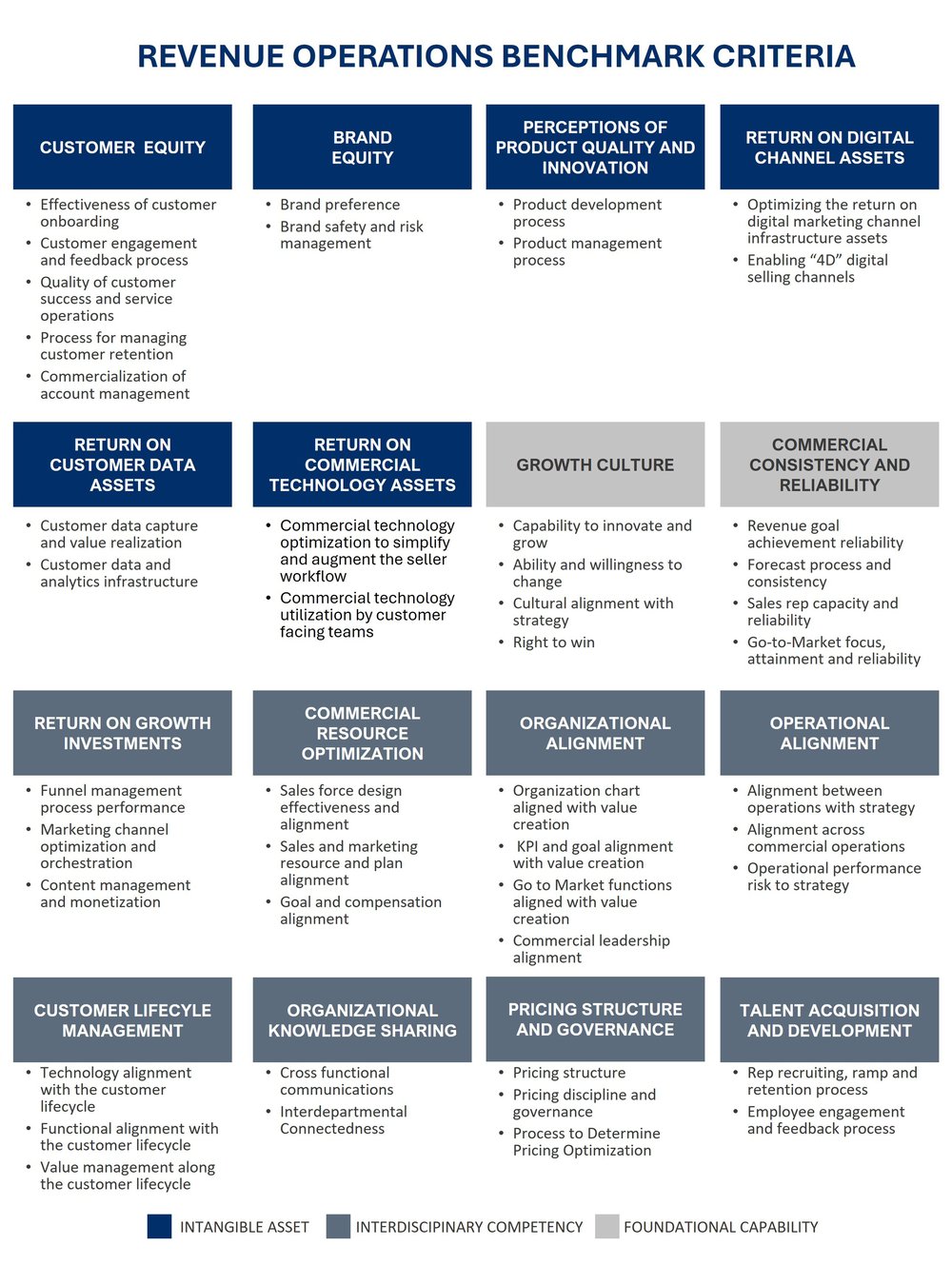

The Revenue Operations Benchmark

The Revenue Operations Benchmark Assesment (RoB TM) is unique because it focuses on the underlying drivers of a company’s potential to grow across the sixteen operational value levers proven to impact future revenues, cash flow, and firm value. RoB TM benchmarks an organizations commercial capabilities, assets, and competencies across forty-six growth drivers that span the functional and operational drivers of growth. These drivers include the critical ability to align operations and teams along the revenue cycle, share and monetize information, and generate returns on growth investments and assets. The resulting RoB TM scorecard provides leaders, operators, boards and investors a fact-based assessment of the probability of hitting future revenue targets and the root cause issues holding back growth. In addition to scores, RoB TM quantifies the latent growth potential in the business and recommends specific growth drivers & action steps that have the greatest potential to unlock that revenue, improve performance, and realize the full growth potential from commercial assets.

Benefits

The RoB TM analysis helps growth leaders, boards, and CEOs to maximize the revenue potential of their businesses by proactively addressing the top obstacles, capability gaps, and execution risks associated with Revenue Operations. Our proprietary and comprehensive analysis will help you to:

- Identify the root cause issues behind inconsistent revenue growth, revenue leakage, and high selling costs

- Develop a holistic plan to drive value creation that spans the people, process and technology aspects of growth

- Unify stakeholders around a common plan, financial model, and ‘vocabulary’ for Revenue Operations

- Empower CROs and RevOps leaders to get the cooperation, budgets and behavior change needed to succeed

- Provide benchmarks and KPI’s to manage growth resources based on customer and firm value creation

- Agree on a financially valid basis for optimally allocating commercial resources, effort, and investments

- Prioritize the hundreds possible growth initiatives to focus on the 3-5 that matter most

- Make intelligent long term investments in the channels, systems, and data infrastructure that create scale

- Set realistic expectations about the time, change management, capability building and investment involved.

- Improve the ownership, accountability, and performance of the commercial assets, processes and resources